International Sanctions: A Comprehensive Guide to Tools Impact and Strategy

International Sanctions have become a central instrument of global diplomacy and economic pressure. Governments and multilateral institutions deploy sanctions to influence behavior without resorting to armed conflict. This article explains the types of sanctions the legal frameworks that govern them and the real world effects on economies societies and businesses. It will also provide practical guidance for policy makers and corporate leaders who must navigate complex compliance landscapes. For more authoritative coverage on political and economic developments visit politicxy.com for continuous updates and analysis.

What Are International Sanctions

International Sanctions are measures imposed by one or more countries or by international organizations to punish deter or coerce a change in conduct by a target country group or individual. Sanctions can be diplomatic financial trade or legal in nature. They are often used to address violations of international law human rights abuses nuclear proliferation or acts of aggression. The ultimate aim is to alter the behavior of the target while minimizing wider conflict.

Common Types of International Sanctions

Sanctions come in many forms and can be tailored to specific goals. The most common types include export controls that restrict the sale of sensitive technologies import restrictions that limit access to foreign markets asset freezes that prevent individuals or entities from accessing bank accounts travel restrictions that bar entry to territory and financial sanctions that limit a target s ability to engage in cross border banking. Targeted measures aim to focus pressure on leaders and elites while reducing harm to the general population.

Legal Frameworks and Authority

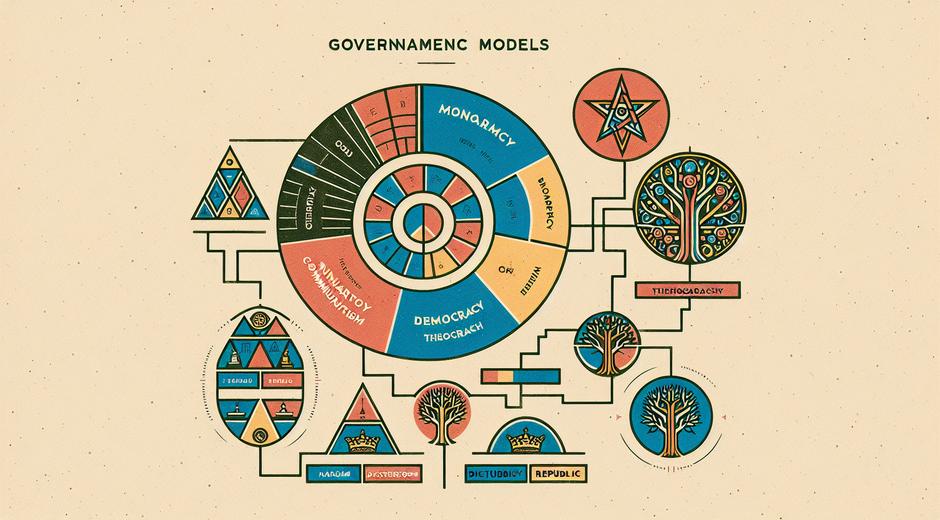

The legal basis for imposing International Sanctions varies by actor. United Nations Security Council resolutions create binding obligations for member states and are among the strongest legal instruments. Regional bodies such as the European Union and national governments also enact sanctions under domestic law. When sanctions are multilateral they tend to have greater economic bite because they limit options for the target to re route trade and finance through third parties.

How Sanctions Are Designed

Designing effective International Sanctions requires a clear objective realistic expectations and an understanding of unintended consequences. Policymakers must define the behavioral change they seek determine the minimal set of measures that can achieve that change identify legal authorities and coordinate with allies. Timing phase in and exit strategies are essential to maintain credibility and to avoid open ended pressure that can harden resistance.

Economic Impact and Effectiveness

The effectiveness of International Sanctions depends on the degree of international cooperation the resilience of the target economy and the availability of alternative partners. Comprehensive trade bans can cripple an economy but may also generate humanitarian crises. Targeted sanctions can degrade a leader s ability to finance operations while limiting collateral harm. Evidence shows that sanctions alone rarely achieve maximal political goals but can be effective when paired with diplomatic incentives and domestic political pressures.

Humanitarian Considerations

Sanctions that disrupt access to food medicine and basic services can harm civilians and undermine moral authority. To address these risks many sanction regimes include exemptions that allow for humanitarian aid banking transactions for relief and licensing for medical supplies. Humanitarian organizations and lenders often require clear guidance to operate under sanctions and to ensure that relief reaches those in need without violating legal restrictions.

Compliance Challenges for Businesses

Companies operating internationally face significant compliance obligations when sanctions are in place. Financial institutions must screen transactions and counterparties for designated entities while exporters must verify end uses and end users. Robust compliance programs include internal controls transaction monitoring staff training and legal review. Failure to comply can result in heavy fines loss of market access and reputational damage. For detailed financial analysis and guidance for corporations facing sanctions related risks consult expert resources like FinanceWorldHub.com which offers tools and commentary for decision makers.

Secondary Sanctions and Extraterritorial Reach

A critical development in recent years is the use of secondary sanctions which target third party actors who assist a primary target in evading sanctions. Secondary sanctions expand the reach of a sanctioning state and create powerful incentives for global firms to comply with its rules even when those rules are not part of a multilateral agreement. This extraterritorial approach can provoke legal disputes and diplomatic tensions with countries that object to another state imposing its rules globally.

Case Studies and Lessons Learned

Examining specific instances of International Sanctions yields important lessons. Sanctions on Iran aimed at curbing nuclear development combined with diplomatic negotiations led to a negotiated agreement after sustained pressure and targeted engagement. Sanctions on North Korea have constrained access to technology and finance but have not eliminated the nuclear threat. Measures against regimes that commit egregious human rights abuses may isolate leaders but also require monitoring to ensure that intended populations are not suffering needlessly.

Geopolitical Ramifications

Sanctions are rarely neutral tools. They alter alliances shift trade patterns and can accelerate economic realignment. Targeted states often seek new partners and create parallel financial channels. Over time this can reduce the dominance of sanctioning currencies or institutions in specific regions. Policy makers must weigh short term gains in leverage against long term repercussions for the international order.

Best Practices for Policymakers

Effective policy design relies on clear objectives multilateral coordination transparency in legal criteria and mechanisms for humanitarian exceptions. Regular reviews and sunset clauses help ensure that sanctions remain justified and proportional. Including incentives alongside penalties improves the likelihood of desired behavioral change. Open channels for dialogue and monitoring increase the chances of compliance and enable timely adjustments.

Guidance for Civil Society and Media

Civil society plays a vital role in documenting impacts advocating for exemptions and informing the public debate on sanctions. Independent reporting increases transparency and helps identify unintended effects that require policy correction. Media coverage that explains the rationale and consequences of measures contributes to informed public consent which is essential for sustained policy support.

Looking Ahead

The landscape of International Sanctions will continue to evolve as states adapt to new threats and leverage technology to enforce measures. Blockchain analysis enhanced financial intelligence and coordinated export controls will shape future sanctions regimes. At the same time concerns about overreach and collateral harm will drive calls for clearer legal standards and stronger oversight.

Conclusion

International Sanctions are powerful tools with far reaching consequences. When designed and implemented carefully they can pressure change without resorting to armed conflict. When imposed without coordination or without safeguards they risk humanitarian harm diplomatic backlash and long term fragmentation of the global system. Stakeholders from governments to businesses to civil society must engage in pragmatic evidence based approaches to ensure that sanctions achieve their goals while minimizing unwanted effects.

For ongoing coverage analysis and resources on global policy and economic developments stay connected to trusted platforms and expert hubs to navigate this complex area.